When I first arrived in Taiwan, I walked into a night market expecting to pay in coins and bills like back home. But at the first stall, the vendor pointed to a scanner and said, “LINE Pay?” That was my introduction to Taiwan’s cashless culture. In Taiwan, digital wallets, credit cards, and contactless payments are everywhere, and OFWs like me see them daily in stores, buses, clinics, and night markets.

Back home, cash is still king for many of us. But in Taiwan, a tap or scan is often all it takes. This made me curious: Are migrant workers really adopting cashless tools and credit cards? Or do we still prefer the familiarity of cash, remittance counters, and debit withdrawals?

After years of observing fellow OFWs, I realized the answer is not black and white. Taiwan pushes everyone toward cashless payments, but OFWs adopt digital finance differently—and for very specific reasons tied to our lifestyle, priorities, and financial responsibilities back home.

Taiwan’s Cashless Landscape: A Society That Taps, Scans, and Swipes

Taiwan is moving fast toward a cash-light economy. According to government and market data:

| Indicator | Taiwan Reality |

| Credit card consumption | NT$4.68 trillion in 2024 — a record high |

| Cashless transactions | 8.3+ billion transactions in 2024, and still rising |

| Mobile payment growth | 0.6% adoption in 2017 to 11.2% in 2023 |

From Taipei to Taichung, convenience stores, clinics, buses, supermarkets, and food stalls accept digital payment. Cash isn’t gone, but it’s slowly losing ground.

As an OFW, I feel it every day. Whenever I buy milk tea, ride the MRT, or shop at PX Mart, I see locals tap their cards or scan QR codes faster than I can pull cash from my pocket. Exposure shapes behavior—and Taiwan exposes us to cashless systems nonstop.

Are OFWs Using These Tools? Yes—but Not the Same Way Locals Do

Most OFWs in Taiwan are highly exposed to digital payments. But exposure is different from full adoption. Here’s the reality I’ve observed:

- OFWs are comfortable with cashless tools for daily spending

Many now use EasyCard, iPass, LINE Pay, or JKoPay because they’re easy to reload and widely accepted. - But fewer OFWs use credit cards

Not because we don’t want to—but because access and priorities differ. - Remittances still come first

Our financial life is split between Taiwan and the Philippines. Cashless payments are convenient, but remittance is essential.

Why Many OFWs Hesitate to Get a Taiwan Credit Card

Even if an OFW wants a credit card, it’s not always simple. Taiwan’s banking rules can be strict.

| Barrier | Why It Matters for OFWs |

| ARC requirement | No ARC = no card |

| Proof of stable income | Not all employers provide easy documentation |

| Local guarantor (sometimes) | Hard for migrant workers to secure |

| Employment type | Domestic workers often face more hurdles |

So instead of credit cards, most OFWs choose:

- Payroll debit accounts

- EasyCard / iPass

- Mobile wallets

- Remittance-linked accounts

- Prepaid or stored-value tools

And there’s another reason for credit card hesitation: utang fear. Many OFWs are determined to avoid debt because every peso counts for our families.

What OFWs Actually Prefer: Tools That Serve Their Real Priorities

After talking with fellow migrant workers and observing habits, I noticed a clear pattern:

| OFW Priority | Preferred Tool | Why |

| Cheap and fast remittance | Remitly, Wise, bank-linked transfers, or remittance centers | Focus is sending money home, not earning points |

| Everyday payments | EasyCard, LINE Pay, JKoPay | Simple, reloadable, and accepted everywhere |

| Savings and control | Debit and remittance accounts | Less temptation to overspend |

| Avoiding debt | No credit card | Protects monthly budget |

We don’t adopt tools based on trend or lifestyle. We adopt based on responsibility.

Cashless Convenience vs. OFW Discipline: A Balancing Act

Cashless systems can make life easier. No need to carry coins, no need to worry about shortage of change, and no need to line up at ATMs. But convenience comes with risk:

When you pay by tapping, you don’t feel the money leave. Spending can get emotional and impulsive if you are not mindful. I’ve seen roommates swipe or scan too easily—then panic on payday when they realize half their salary is gone.

Cashless works best when paired with discipline. That’s the balance many OFWs are trying to master.

Patterns in OFW Cashless Adoption (Balanced Reality)

Here’s the most accurate way to summarize what’s happening:

| Trend | OFW Reality |

| High exposure | Taiwan’s system encourages cashless behavior |

| Selective adoption | OFWs adopt tools that match their needs |

| Credit caution | Many avoid cards due to debt risk |

| Wallet growth | Mobile payments are rising among younger OFWs |

| Remittance first | Spending tools come second, family comes first |

In short: yes, we are adapting—but on our own terms.

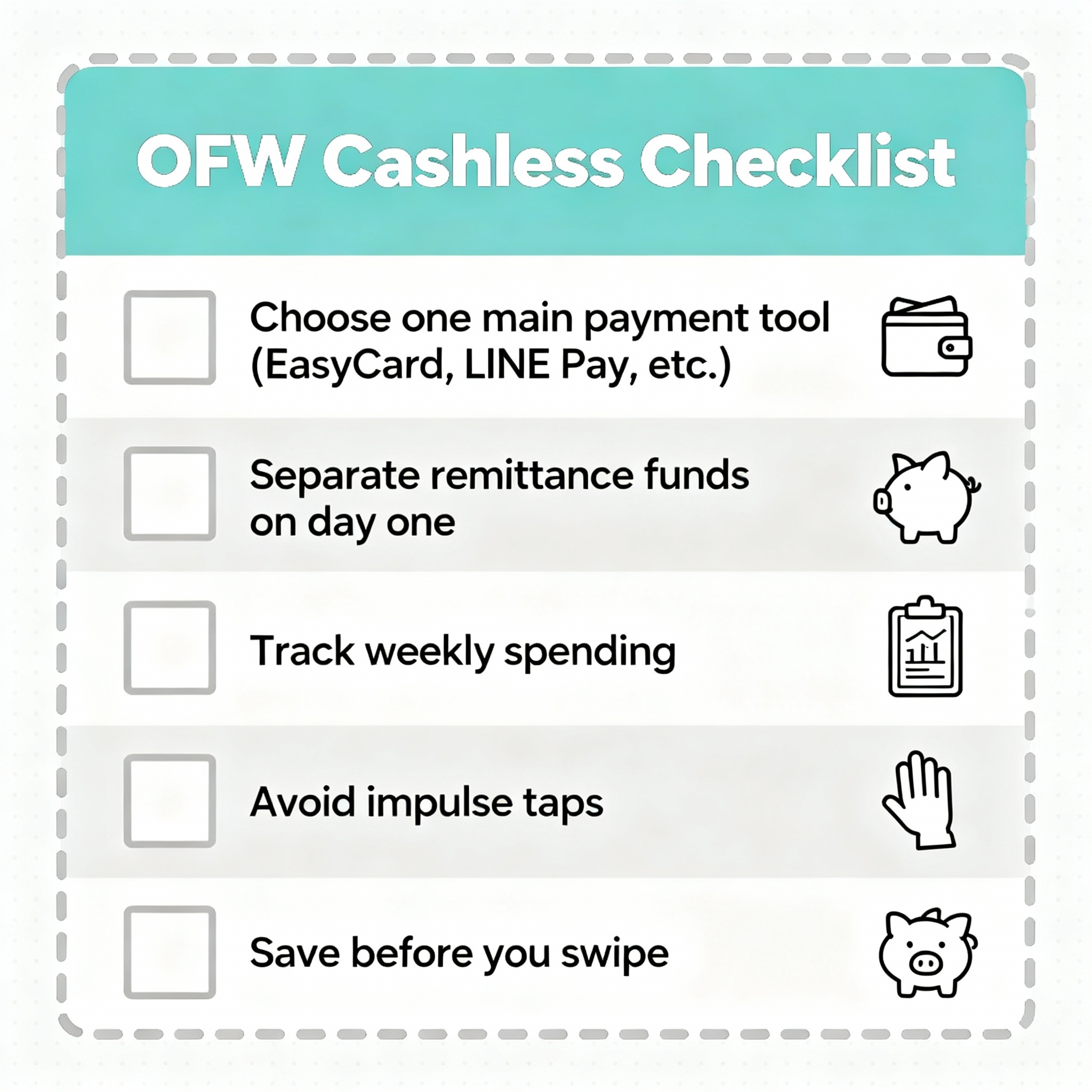

Practical Tips for OFWs Who Want to Go Cashless Safely

If you decide to embrace digital tools, here are responsible ways to do it:

- Use a budget app or notebook

Track every tap, swipe, and scan. - Separate remittance money immediately

Treat remittance as untouchable. - Use EasyCard or wallets for fixed expenses only

Load only what you plan to spend. - If you ever get a credit card, set a monthly limit

Never spend more than 20–30% of your income on card purchases. - Prioritize savings first, convenience second

Cashless is a tool—your goals matter more.

Frequently Asked Questions

1. Is it easy for OFWs to get a credit card in Taiwan?

Not always. While Taiwan is highly cashless, credit card approval for foreigners is stricter than for locals. Banks often require a valid ARC with enough remaining duration, proof of stable monthly income, and in some cases, a local guarantor. For OFWs who work under brokerage contracts or in domestic caregiving roles, these requirements can be harder to meet. Some banks are more flexible, but many OFWs eventually choose alternatives like debit cards, stored-value tools, or digital wallets instead of pushing for a local credit card.

2. Which cashless tool is easiest for OFWs to use?

For daily life, EasyCard, iPass, LINE Pay, and JKoPay are the most beginner-friendly. They are widely accepted—from trains and buses to convenience stores, supermarkets, and night markets. These tools are simple to reload, do not require heavy documentation, and work well even without a credit card. For most OFWs, these options offer convenience without complicated paperwork.

3. Should OFWs use credit cards?

Credit cards can be useful, but only if handled with discipline. They offer convenience, cashless access, and sometimes rewards or cashback perks. However, a credit card becomes harmful when spending goes beyond one’s budget. Interest, late fees, and minimum payments can quickly eat into remittance money. If an OFW knows how to track expenses and pay in full monthly, a credit card can be an advantage—but it requires commitment and self-control.

4. Why do many OFWs still prefer cash or debit?

Control and clarity. Many OFWs find it easier to manage their budget when they physically see what’s left. With cashless tools, spending can feel “invisible,” which leads to accidental overspending. Debit accounts and cash keep expenses grounded and predictable—something important when family needs and remittances are the top priority.

Watch: Over 12 million benefit from Taiwan’s mobile payment international collaborations

Taiwan’s mobile payment systems are now serving over 12 million users, thanks to growing international collaborations. These partnerships allow seamless cross-border transactions, making it easier for travelers and businesses to go cashless. The government and private sector are working hand in hand to boost digital convenience and economic momentum. Advanced tech and AI are powering this shift, helping Taiwan build a smarter, more connected payment ecosystem. This move strengthens Taiwan’s position as a regional leader in digital finance and innovation.

Conclusion: Cashless Exposure, OFW Priorities

Taiwan’s cashless culture is strong and growing—and yes, OFWs are influenced by it. But at the end of the day, our adoption remains practical and selective. We embrace what makes life easier, but we stay cautious to protect our families, salaries, and long-term goals.

Cashless tools are not the enemy, and credit cards are not automatically dangerous. They are simply tools. Used with discipline, they offer convenience. Used without control, they become traps. What matters is not the tap or the swipe, but the mindset behind it.